Warning: this newsletter is long - but so is retirement! Isn't your last 30-40 years, or your legacy, worth 5-10 minutes of your time now?

This is Part 3 of a three part series that will introduce you to the most powerful wealth building asset you probably don’t know about. This is a main pillar of my retirement portfolio and the crux of my business. But before you read on, I urge you to review Part 1 and Part 2 in order to put this letter in its proper context. Please don't go on without reading Parts 1 & 2!

In June, I explained that the Government, Wall Street, the health care system – and by corollary, the mainstream way of investing – are not the solutions, but the problems. I posed the question, “How will you create a financial strategy where you are going to be OK no matter what party is in office, no matter what interest rates are, no matter what happens in the stock market, no matter how volatile the times?”

In July, I described how our economy is immeasurably complex and that attempts to micromanage it will fail and often backfire. Just look at inflation today. It’s hard to imagine that Government policy attempting to tame inflation could have made inflation any worse.

It's time to put the odds in your favor. So, how is it done?

By taking the financing process away from the banks and “banking on yourself.” For the remainder of this letter, please keep an open mind and consider the possibility for just 5 minutes that what I say is true. Just for a moment, put aside what you already “know!”

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so."

--- Mark Twain allegedly did not state this line attributed to him in The Big Short. But is it not true?

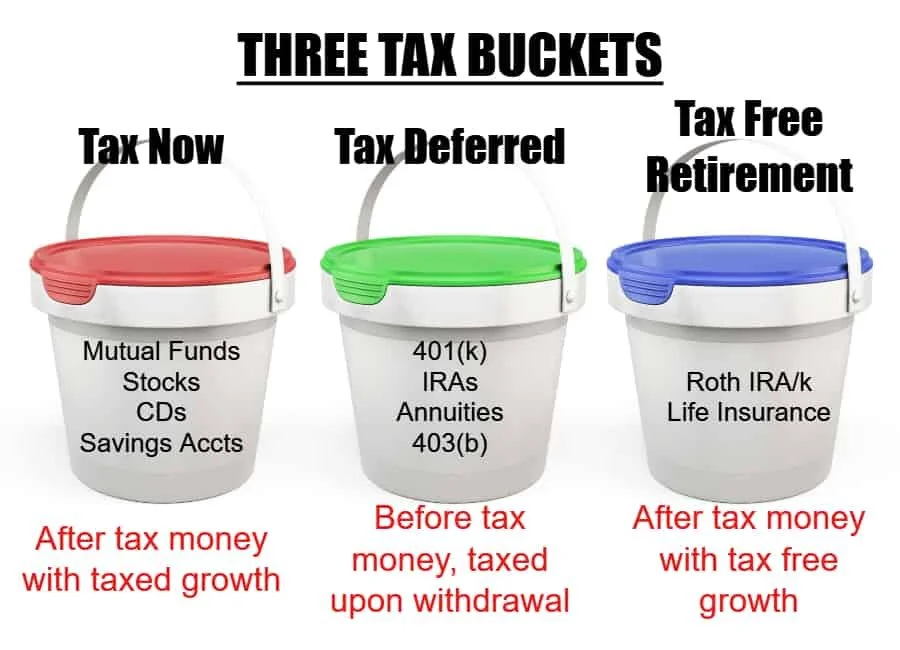

What if you had an account where you could contribute an unlimited amount of money into it and never pay taxes again, either on the growth or the distribution? Kind of like a Roth, but without income or contribution limitations, or the requirement to wait until you’re old to access it?

What if the balance in this account was safe and contractually guaranteed only to go up, like a savings account, but was associated with 20-40 times the growth rate of today's savings or money market-type account, and without the taxation? Would you put any money into something like this?

What if instead of paying interest, this account paid tax-free dividends, which, while not guaranteed, have been paid for more than 100 consecutive years, including during the Great Depression?

Crazier yet, what if you could access the value in this account at any time you want, for any thing you want – yet even if you accessed your cash value, your dividend would be unaffected?

Think of it. Let’s say you had $500,000 in an IRA and you borrowed $400,000 from it. You would have $100,000 still working for you in the IRA, right?

But what if you borrowed $400,000 from your IRA for an endeavor of your choosing but you still had the full $500,000 working for you in the IRA? I’m sorry to say you can’t do that with your IRA, but you can do exactly that with my strategy. That’s why it’s called, among other things, “becoming your own banker.”

This should be starting to sound pretty amazing, maybe even incredible. So remember my request earlier – just for fun, daydream with me and enjoy the thought.

What if this program also came with a permanent death benefit? Not a temporary death benefit that comes with term life insurance, but one with a 100% probability of being paid, tax-free? Where if your life tragically came to an end during the first year, the payout to your family would be as if you had been productively investing for decades, instead of months?

What if the death benefit could be advanced to you during your own lifetime for the purpose of long-term care, should you need it? At the same time, if you were to die peacefully in your sleep at age 110, you wouldn’t have wasted any money on health premiums you didn’t use.

Would that be useful in a nation whose Medicare, Medicaid and Social Security trust funds are nearly depleted?

I have just described to you a type of uniquely structured life insurance asset called dividend paying whole life. This discussion isn’t about life insurance, though. It is about finding the best solution to an array of serious problems we face, whose vehicle, because of its remarkable attributes, happens to be life insurance.

Through properly designed cash value life insurance, you can:

1. Protect your money from loss through contractual guarantees.

2. Grow your money safely and efficiently, at a significantly faster rate than other safe money assets (savings, money markets, CDs, etc).

3. Turn a virtually unlimited amount of taxable dollars into tax-free.

4. Leverage – by having one dollar to do the work of several dollars.

5. Take advantage of volatility, market crashes and inflation, rather than suffer from them!

6. Enjoy an insurance and long-term care benefit, but without the possibility of any wasted premiums.

7. Avoid probate.

8. Take the process of financing away from reckless banks and enrich yourself rather than them, by assuming control of your own money.

Learning this strategy has completely changed my financial situation and created financial peace for my family and for numerous clients.

No financial strategy should consist of merely one asset class, whether it be a 401(k), real estate, precious metals, or life insurance. But most people not only haven’t found a place for this astonishing asset, they don’t even know about it!

Why not? Because they don’t want you to know about it. “They” are the banks and the asset managers who don’t get to handle and profit from your money if you’re making it work for you instead! Curiously, while banks will never tell you about this, bank executives owned more than 182 BILLION dollars’ worth of Banked Owned Life Insurance (BOLI) in 2020. Interesting!

If something like this existed, wouldn’t you at least want to know about it? Or would you rather be “all-in” at the Wall Street 401(k) casino with your retirement money?

Finally, when would you like to figure this out – before, or after the next crash?

There is abundant information about this strategy, even though you may never have heard about it. Check out these resources. If you get in touch, I may even send you one of these books for free.

Becoming Your Own Banker - Nelson Nash

Bank on Yourself - Pamela Yellen

What Would the Rockerfellers Do? - Gunderson

Money. Wealth. Life Insurance - Thompson

How Privatized Banking Really Works - Lara & Murphy

Double Jeopardy - Renier

The LIRP vs. Stock Market Investing.

Part 3: Re-Introduction of Cash Value Life Insurance – September 2022 (Pdf Download)

Contact us for a free 15-minute phone consultation.

Thank you for your time and for taking control of your financial future!

Sincerely,

Sam Arieff

Arieff Consulting

(904) 478-0102

* Dividends are not guaranteed. However, companies we use have paid dividends without fair for more than 100 consecutive years.

Disclaimer: This newsletter represents the opinion of Arieff Consulting, Inc, and does not constitute financial, tax, or legal advice.