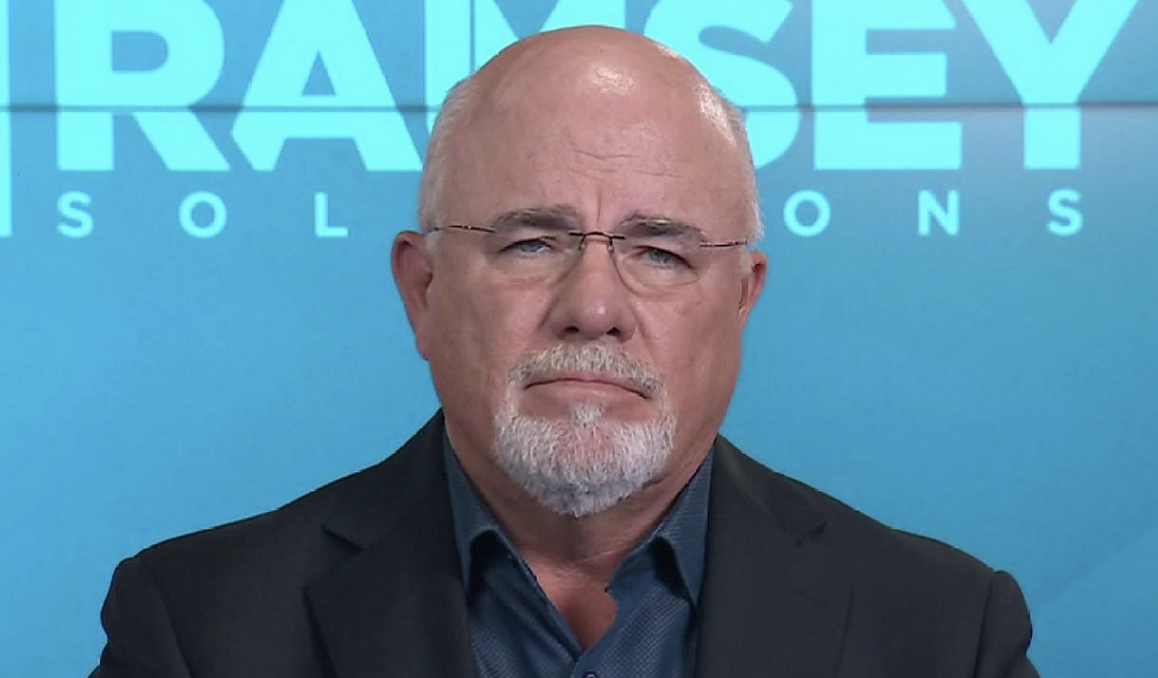

It is not uncommon in my business to encounter Dave Ramsey fans, advocates, and disciples. In fairness, Dave has helped thousands, maybe millions, of people overcome destructive financial behaviors like amassing credit card debt. I have no doubt he means well.

But to say I have major differences with Ramsey is an understatement. This newsletter explains why, as well as provides a bibliography of sources for you to judge for yourself whether Dave Ramsey is a guru who should be guiding your financial decisions.

One major difference is our target audience. Though I’m happy to help anyone who needs it, I don’t typically work with people drowning in debt or who can’t manage a budget. My clients may or may not have high income yet, but they have the desire and discipline to save. They’re not staring down financial ruin.

Dave sells millions of books and subscriptions. To sell all that, his message must apply to a lowest common denominator, leaving little room for nuance or exceptions to his black-and-white advice.

Which type of investor are you? If you are an educated, disciplined professional; if you pay your credit cards off each month; if you seek financial guidance based on your unique situation and desires; is Dave really your man?

The most significant dispute I have with Ramsey, however, is his financial philosophy. Dave’s has never changed with the times, and I’d call it religion more than a strategy. It is wrought with contradictions. On one side of his mouth, he asserts with complete confidence that anyone can make 12% consistently in the stock market, which is ridiculous. But then, out of the other side of his mouth, he implores you to pay off your home as soon as possible. Whether the interest rate on that house is 2% or 10%, his command to pay off the house immediately has never deviated.

Why in the world, if you can confidently make 12% in the market, would you take an extra $1000 a month and pay off your 2% mortgage, missing out on the difference of 10% per year of growth, according to Dave’s math? This defies any rationality.

Dave’s logic can and has been debunked multiple times in all sorts of ways, most importantly using math and objective data. And as of late, it’s really been getting to him. Dave has exploded into rants when he’s been confronted with contradictory information, not only by his own guests but by his own cohosts. It has not been pretty.

There are 2 "Davisms," concepts Dave believes unquestionably. The first is that the S&P "returns" 12% consistently over time. A quick internet search, however, reveals that S&P growth was within 1 percentage point of 12% only a few times in the last 50 years!

The second Davism is that one should be able to take a whopping 8% from their retirement nest egg per year and never run out of money, despite the conventional recommendation being 4% and even as low as 2.88% (download this Wade Pfau retirement optimization article).

As these untruths foundational to Dave's advice have been questioned and, frankly eviscerated, he continues to cling to this gospel and lash out at any defectors as "morons who live in their mothers' basements" and "go down these stupid nerd rabbit holes!”

While I gave deserved kudos to Dave in the first paragraph, if you peel back the onion a bit you will see that Dave Ramsey is a generalist who has no interest in the data. Rather he attacks those who have conducted vigorous financial analysis as well as the research itself. He is astoundingly and irresponsibility poor at math. And by the way, he’s not a licensed financial professional.

While Dave Ramsey is a godsend for certain people, it is vital to expose his faulty methods and advice. Why? Because if you follow his advice, your financial plans have a much better chance of failing!

You don’t buy one-size-fits-all underwear. Should you do it with your retirement advice?

Dave Ramsey Eviscerates Co-Host George Kamel for Preaching the 4% Rule (The Power of Zero podcast, 11/22/2023)

The Caller on Dave Ramsey’s Viral 4% Rule Meltdown Speaks Out! (The Power of Zero podcast, 11/29/2023)

HonestMath.com Weighs In On Dave Ramsey’s Epic Meltdown Over the 4% Rule (The Power of Zero podcast, 12/27/2023)

The Rich Don’t Listen to Suze Orman or Dave Ramsey (Forbes, 3/20/2021)

Ramsey Beat the S&P 500 Over the Last 30 Years Because “It’s not hard to do.” (The Power of Zero podcast, 10/11/2023)

How to Get Rich the Dave Ramsey Way! (The Power of Zero podcast, 11/8/2023)

Dave Ramsey is WRONG About Fixed Indexed Annuities (The Power of Zero podcast, 9/23/2023)

The Truth About Dave Ramsey’s Investment Philosophy (The Power of Zero podcast, 8/2/2023)

Dave Ramsey Is Disastrously Wrong on Roth Conversions (The Power of Zero podcast, 6/28/2023)

Why Dave Ramsey Uses Disgust to Get You to Believe Him (Not Your Average Financial Podcast, 11/10/2023)

Dave Ramsey v. Pamela Yellen, A Bank on Yourself Battle Royale

(Not Your Average Financial Podcast, 2/1/2019)

Ok, Dave Ramsey, You’re Right. “Whole Life Stinks…” (Not Your Average Financial Podcast, 1/25/2019)

The Seven Baby Steps and the Dave Ramsey Gospel (Not Your Average Financial Podcast, 1/18/2019)

Supernerds Unite Against Dave Ramsey’s 8% Safe Withdrawal Rate Guidance