The last 3 newsletters (July, August, September) described the context supporting and identified the strategy of using cash value life insurance as an optimal financial vehicle. Optimal for what?

· For reclaiming control of your money and self-financing life’s major purchases to your benefit rather than the banks.

· By avoiding stock market losses associated with crashes and even exploiting them.

· By providing for your own long term health care, at no extra cost, just in case the government-run and influenced health care system proves to be insufficient.

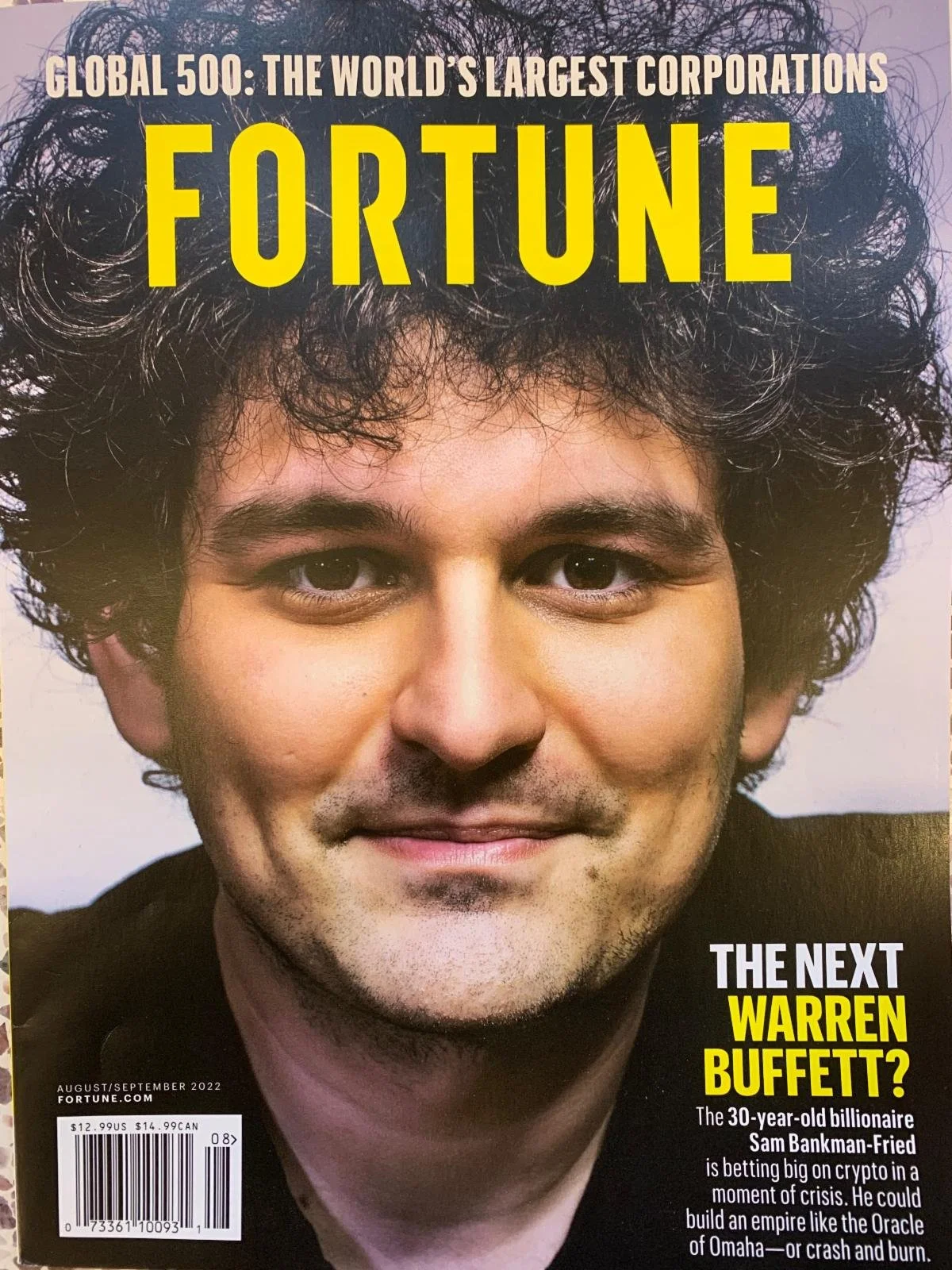

Why are bankers so rich? Because they are always handling our money, and every time turning profits. What a scam they have going on. They get their money from you in the form of checking and savings. In return they generously offer you less than one half of a percent of interest (which is taxed by the government, no less)! Then they loan it out at 6% for a home loan or 25% for a credit card. They charge you ATM fees, late fees, and finance charges.

Even if you don’t pay interest on your credit cards, they still charge the merchants a transaction fee. So they still make money on each transaction, and of course that fee is passed on to you in the form of higher prices, since the merchants don’t want to pay fees either!

Banks then leverage their assets in the most outrageous and irresponsible ways, which results in crashes, like the global financial crisis of 2008. But they don’t need to worry about that, because thanks to the arrangement they made with the government in 1913 when they created the Federal Reserve, if and when the house of cards comes crashing down, they get bailed out by the Government. But wait, where does the Government get its money?

From YOU! You’re the bailout plan.

We’re all in the banking business. The question is, what side of the table are you on?

So, how can you cut the banks out of the financial process and enrich yourself instead? By storing your money not in a bank account but inside a cash value life insurance contract.

It is guaranteed against loss.

It grows multiple times faster than savings accounts and CDs.

It grows and distributes TAX-FREE if structured correctly.

It provides a death benefit and a chronic care benefit.

It’s private, creditor proof, and incontestable in court.

But best of all,

It doesn’t preclude you from putting your money towards any other financial asset – in fact it enables it!

When you borrow against the cash value in your life insurance policy, the dividend that is paid is distributed whether or not you borrowed any money.*

Come again? Think about it. Let’s say the stock market crashes and is down 40% (like in 2002, 2008, 2020, and 20??). You have $200,000 in cash value that you’ve built up, and you borrow $150,000 against your policy to invest in assets that are 40-60% off their highs. Could you lose money? Absolutely, but could we agree that we’re likely to make a lot more money investing after a major crash than at the peak of the bubble? Let’s assume that these investments pay off. Whether or not they do – and this is the critical point – the dividend on your policy is paid on the full $200,000, not $50,000!

This is why it’s called “Becoming Your Own Banker” or “Bank on Yourself.” You have leveraged your money to be in two places at once. Oh, and all the while you have a valuable, permanent, life insurance and chronic care benefit.

Why would you want to constantly hand the banks your money so they can enrich themselves and repeatedly bring down the economy, when you can bank on yourself, without the recklessness and damage to our financial system?

Isn’t it time to reconsider what is considered the normal and acceptable way of creating wealth?

In the next newsletter we’ll look at how “normal” is working out.

Learn more about cash value life insurance. Easy opt in, easy opt out. No selling or sharing of your information.

Becoming Your Own Banker – November 2022 (Pdf Download)

Contact us for a free 15-minute phone consultation.

Thank you for your time and for taking control of your financial future!

Sincerely,

Sam Arieff

Arieff Consulting

(904) 478-0102

* Dividends are not guaranteed. However, companies we use have paid dividends without fair for more than 100 consecutive years.

Disclaimer: This newsletter represents the opinion of Arieff Consulting, Inc, and does not constitute financial, tax, or legal advice.