I’ve had cash value life insurance policies for 8 years now, and I’ve been in this business for 7. So, some people on this newsletter have been hearing about this from me for 6 years!

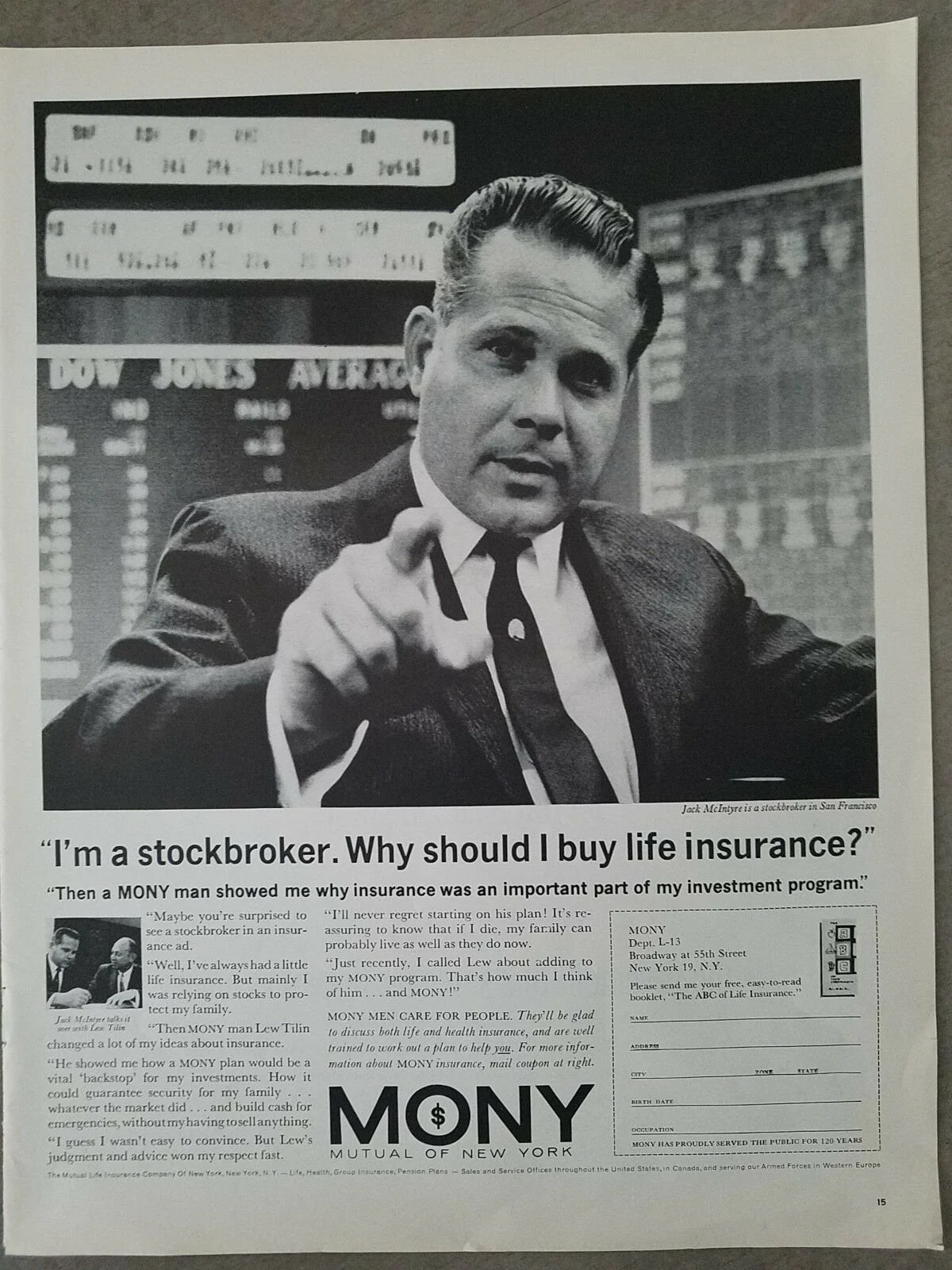

A question I’ve heard over and over is, “If this is such a great thing, why haven’t I heard about this already?” I had the same question. By now, chances are you have heard about this from someone besides me.

A couple weeks ago I referred to the Passive Income Pilots podcast about the pilot who funded his own retirement flight. Well, again I get to give them free promotional content. On July 30th, Episode 70 dropped which was called “Leveraging Life Insurance for Passive Income…”

If you listen to the episode, you’ll hear much of what I’ve been saying for years. I have numerous letters explaining the pros and cons of this approach, and I’ve provided countless resources and links to help you become educated on this amazing strategy. If you’d like, just let me know and I’ll help you find any of this information or answer your questions.

Here are key insights I have regarding this podcast:

First, the hosts are highly sophisticated financial professionals and pilots. They’re successful and knowledgeable, and they have hosted 71 podcasts on financial topics, some of which even I have never heard about. Yet, these guys just started their first policies in the last year!

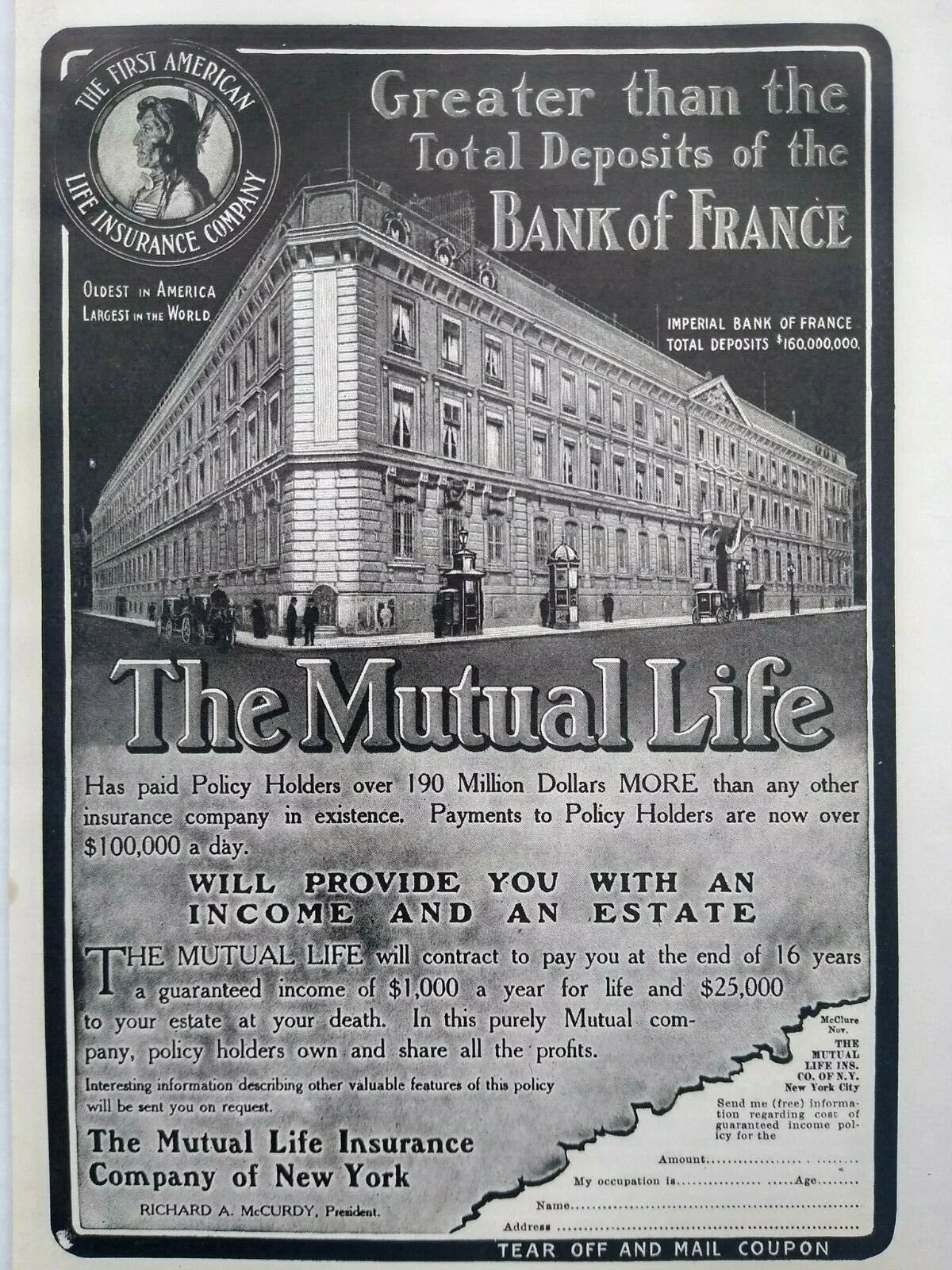

Life insurance has been around for hundreds of years. This strategy has existed for about 25 years, with the first book written on the topic in 2000 - Becoming Your Own Banker by Nelson Nash, sound familiar? Hundreds of thousands of people utilize this strategy, but in a country with 330 million, that’s still only a fraction. While I may have been the first crazy guy to tell you about this, more and more people are waking up and coming to the movement. And it is a movement.

Is life insurance as a financial strategy really that new of a concept?

My favorite line in this podcast:

“We have to apologize for not telling our listeners sooner about this strategy!”

When have you ever heard something like that? With 69 previous episodes, these guys realize in real time that this is one of the most consequential. They rank it with their top episodes even as they record it. They’re raving about cash value life insurance even though they don’t sell it themselves.

Second point:

THIS IS NOT AN INVESTMENT!

The hosts say so. I suggest this over and over to people. We have been financially programmed to compare all financial products to a stock or mutual fund, and to focus only, or nearly exclusively, on Rate of Return. Why? Because that’s all they've got (traditional market-based assets and oh-so-average financial advisors)!

I say again, this is not an investment. Saying it is an investment not only is incorrect and non-compliant, but it’s degrading to cash value life insurance.

This is a place where you store your money, where it grows OK and provides important tax and insurance benefits, which is private and not federally overseen, which, for a low cost, allows you to invest in whatever the heck you want to invest in.

Remember this phrase:

Put Your Money to Work Before You Use It.

In this case, you are running your money through a life insurance filter before putting it to work in real estate, the market, crypto, wherever. The life insurance grows decently and predictably on its own, certainly in a way that competes favorably against other “safe” money assets like CDs, money markets, and (unsafe) bonds. But the real growth is in how you leverage the policy.

Once more, say it with me! Life insurance is not an investment. It’s insurance. Because it’s insurance, it enjoys arguably the most advantageous treatment in the tax code. Because it’s insurance, it provides a tax-free death benefit and chronic care benefit. Because it’s insurance, it has a business model that is stable, based on highly predictable actuarial data – as opposed to the speculative Wall Street model that is built on risk, marketing and Short-Termism. By running your money through this vehicle, you can secure these benefits along with whatever success you are able to create when you access the money anytime you want for anything you want.

This concept involves a rewiring of the brain. You’ve got to think differently than you’ve been trained to think by the forces that spend billions of dollars in marketing costs to make your retirement dependent on the stock market.

This concept involves a rewiring of the brain. You’ve got to think differently than you’ve been trained to think by the forces that spend billions of dollars in marketing costs to make your retirement dependent on the stock market.

Finally, I'd add that long-term care is too often overlooked. When I first started, I didn’t care about death benefit or long-term care. Eight years later, I’ve had young friends get diagnosed or die of cancer as well as encounter all sorts of unpredictable medical events.

The podcast spends a minute on the chronic care benefit at the very end, but I cannot overstate the importance of addressing long-term care whether you're young or old and whether or not you have children. After all, if you don't marry or have children, then who is going to be there to care for you when you get sick? The death benefit could be more important to you if you don't have family.

I also know that our health care system is incredibly expensive and is going to be existentially strained in the future as tens of millions of baby boomers retire and stress the inefficient and corrupt health care system. Even with a military pension in sight, I’m under no illusion that government-provided health care is going to be sufficient for me or my family.

The chronic care component of cash value life insurance is essential (and free!), as is the death benefit, and should not be trivialized.

The hosts mention that podcasts are a great way to get educated, but if you’re not taking action, you’re not taking advantage of the information. I couldn't agree more.

If you knew or even suspected that something like this exists, when would you want to get started, before or after the next economic or medical catastrophe?

August 2024 – Podcast #70 on Cash Value Life Insurance(Pdf Download)

Contact us for a free 15-minute phone consultation.

Thank you for your time and for taking control of your financial future!

Sincerely,

Sam Arieff

Arieff Consulting

(904) 478-0102

* Dividends are not guaranteed. However, companies we use have paid dividends without fair for more than 100 consecutive years.

Disclaimer: This newsletter represents the opinion of Arieff Consulting, Inc, and does not constitute financial, tax, or legal advice.